In the intricate world of finance and trading, various tools and charts are employed to analyze market trends and make informed decisions. One such tool that has gained attention in recent years is the “Main Bazar Panel Chart.” This chart is particularly popular among traders and investors in emerging markets, where it provides critical insights into market movements and potential investment opportunities.

In this article, we will delve into what the Main Bazar Panel Chart is, its components, how to interpret it, and its significance in financial analysis.

What is the Main Bazar Panel Chart?

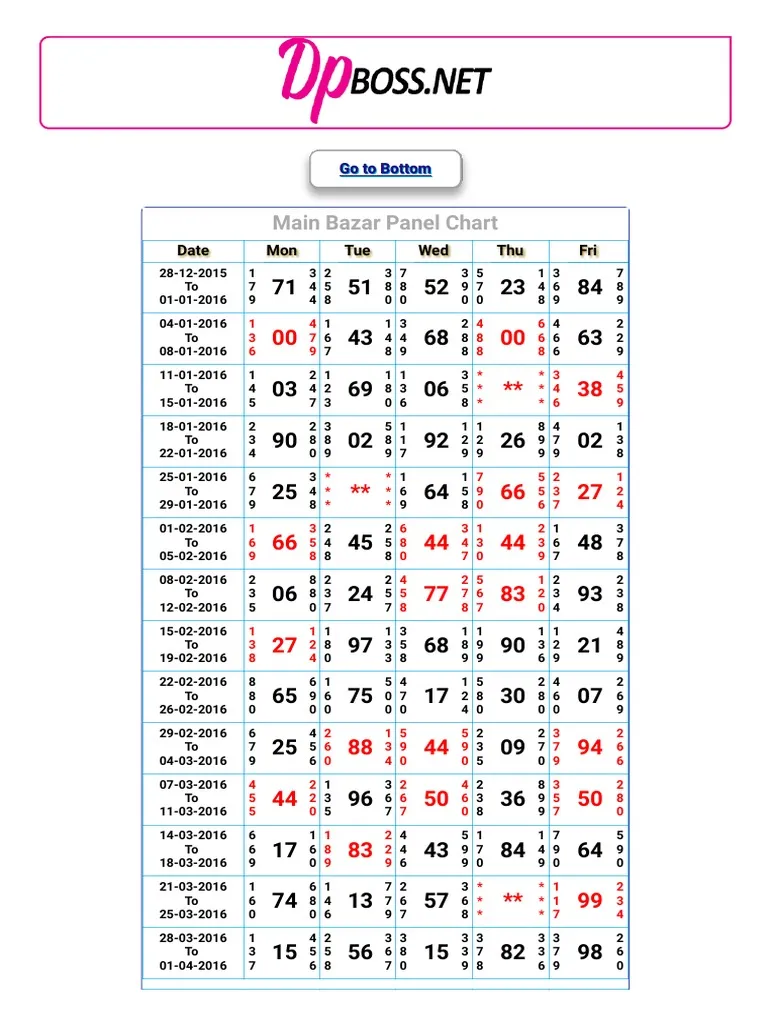

The Main Bazar Panel Chart is a specialized financial chart used primarily in emerging markets, especially in South Asia. Its primary function is to offer a detailed visual representation of market data, including stock prices, trading volumes, and other relevant financial metrics. The term “Main Bazar” translates to “Main Market” in English, reflecting its focus on the principal trading venues or stock exchanges within a region.

Unlike more conventional financial charts that might be used on global exchanges, the Main Bazar Panel Chart is tailored to capture the unique characteristics of regional markets. This includes factors such as local trading practices, market sentiment, and specific economic indicators that can influence market behavior.

Components of the Main Bazar Panel Chart

A Main Bazar Panel Chart typically consists of several key components:

- Price Data Panels: These panels display the historical and current prices of stocks or securities. They often include various types of charts, such as line charts, bar charts, or candlestick charts, each providing different insights into price movements over time.

- Volume Panels: Trading volume is a crucial indicator of market activity. The volume panel shows the number of shares or contracts traded over a specific period. High trading volumes often signal strong market interest or significant price movements.

- Technical Indicators: These include tools such as moving averages, Relative Strength Index (RSI), and Bollinger Bands. Technical indicators help traders and investors identify trends, potential buy or sell signals, and market momentum.

- Market Sentiment Indicators: These panels capture the overall sentiment of the market, which can be based on factors like investor sentiment surveys, news headlines, or economic reports. Understanding market sentiment is essential for predicting potential market directions.

- Economic Data Panels: In emerging markets, economic indicators such as inflation rates, interest rates, and GDP growth can significantly impact market performance. The Main Bazar Panel Chart may include panels that display this economic data to provide context for market movements.

How to Interpret the Main Bazar Panel Chart

Interpreting the Main Bazar Panel Chart requires a solid understanding of its various components and how they interact. Here are some tips on how to read and analyze this chart effectively:

- Analyze Price Trends: Start by examining the price data panels. Look for patterns such as uptrends, downtrends, or sideways movements. Use technical indicators to confirm these trends and identify potential reversal points.

- Monitor Trading Volumes: High trading volumes can indicate strong investor interest and potentially significant price movements. Compare volume data with price changes to assess the strength of a trend.

- Utilize Technical Indicators: Apply technical indicators to gain insights into market momentum and potential entry or exit points. For example, a moving average crossover might signal a buying opportunity, while an RSI reading above 70 could indicate an overbought condition.

- Consider Market Sentiment: Gauge market sentiment by reviewing relevant indicators and news sources. A positive sentiment might support a bullish outlook, while negative sentiment could signal potential risks.

- Review Economic Data: Pay attention to economic data panels to understand how broader economic conditions might be influencing the market. For instance, rising interest rates could affect stock prices and trading volumes.

Significance of the Main Bazar Panel Chart

The Main Bazar Panel Chart holds particular significance in emerging markets due to several factors:

- Local Relevance: It provides a tailored approach to analyzing regional markets, capturing local trading patterns and economic conditions that might not be reflected in global charts.

- Enhanced Market Insight: By integrating various data panels, it offers a comprehensive view of market dynamics, helping traders and investors make more informed decisions.

- Trend Identification: The chart helps in identifying trends and potential opportunities within the market, allowing for strategic trading and investment decisions.

- Risk Management: Understanding the various components of the chart can aid in assessing market risks and managing investment portfolios more effectively.

Conclusion

The Main Bazar Panel Chart is a valuable tool for traders and investors focusing on emerging markets. Its comprehensive approach to displaying price data, trading volumes, technical indicators, market sentiment, and economic conditions makes it an essential resource for making informed financial decisions. By understanding how to read and interpret this chart, market participants can gain a deeper insight into regional market dynamics and enhance their trading strategies. Whether you are a seasoned trader or a newcomer to emerging markets, mastering the Main Bazar Panel Chart can provide you with a significant edge in the complex world of financial markets.