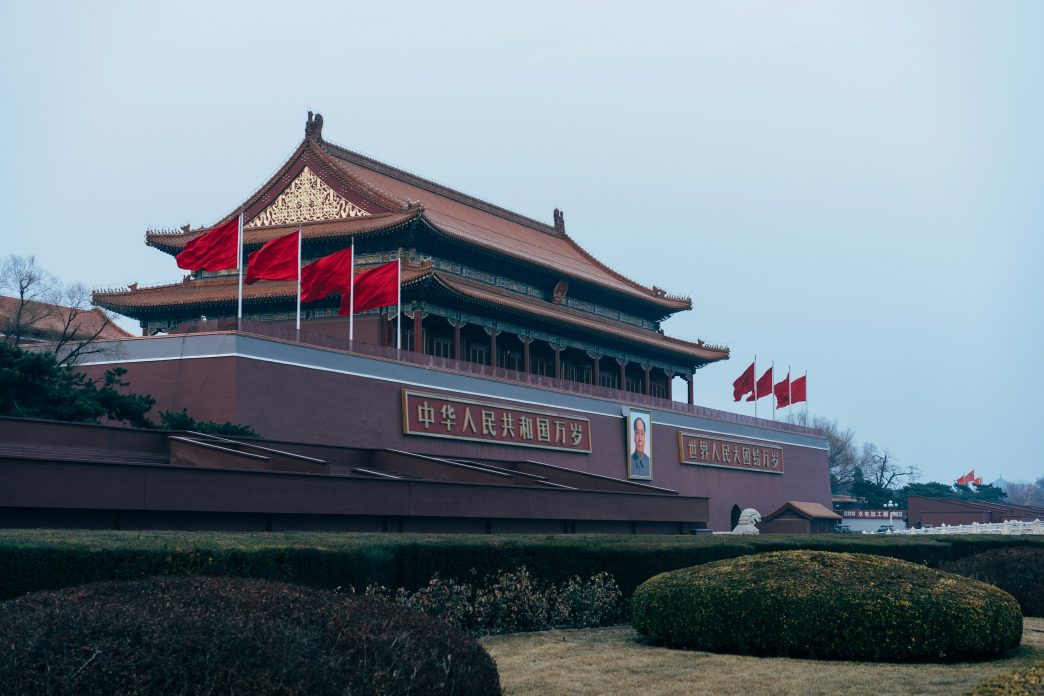

deVere CEO warns of full-scale US-China trade war as Trump hikes tariffs to 125% and China retaliates, escalating risks for investors. The world’s two largest economies have moved beyond “shadowboxing” and are now locked in a full-blown trade war, says Nigel Green.

His comments come in the wake of President Donald Trump’s decision to raise tariffs on Chinese imports to 125%, triggering an immediate retaliatory response from Beijing. Green warns that this sharp escalation marks a dangerous turning point—with far-reaching consequences for global investors and markets.

The escalation is sharp and unmistakable. Trump’s move came just hours after China slapped an additional 50% tariff on US goods, piling on top of the 34% tariffs it had already announced. No longer a war of words, this is now a war of action—and the effects will ripple through every major asset class, industry, and economy,” says Nigel Green.

At the same time, Trump announced a 90-day pause on the full implementation of tariffs for certain countries, citing outreach from more than 75 nations eager to negotiate. This partial step-back is an acknowledgment that the risks of economic blowback are real and rising.

“The gloves are off,” says Nigel Green.

“For investors, this likely marks the start of a period of profound volatility, profound opportunity, and profound risk.”

He continues: “The myth that trade wars are ‘easy to win’ has been shattered.

“When the world’s two largest economies go head-to-head, there are no easy winners—only shifting damage.”

For investors, the message is stark: assumptions based on years of relative trade peace must now be revised.

Diversification across asset classes, sectors, and geographies becomes even more critical.

Strategies that depend heavily on continued global growth will need to be stress-tested under the reality of a slowing, more fractured world economy.

Trump’s 90-day pause for non-retaliating countries highlights another key truth: markets, businesses, and consumers have zero tolerance for sustained economic instability.

“The administration’s pivot shows that even the architects of aggressive policies must respond when the costs become too visible to ignore.”

Still, the underlying trajectory is clear.

“The US-China relationship is entering a period of open hostility that will not easily unwind. Even if negotiations resume, the trust required for genuine cooperation has been badly eroded.”

For now, markets will likely oscillate between hope and fear. Sharp rallies on the slightest hint of diplomacy will be followed by brutal sell-offs when hostilities deepen. Investors who are prepared, agile, and globally diversified will be best positioned to ride these waves.

Investors must avoid complacency, resist emotional reactions, and recognize that the game has fundamentally changed.

“The US-China trade war is no longer a risk—it’s a reality,” Nigel Green says. “And those who adapt fastest will not only protect their wealth—they will find opportunities others miss.

“The era of easy assumptions is over.”