For many working adults, turning 30 represents a huge milestone. The beginning of your fourth decade of life is an apt time to do a bit of introspection about major subjects. It’s also an appropriate age for saying goodbye to bad habits and dead-end pursuits. Consider doing an honest review of your career situation before turning 30, and don’t be afraid to explore changing gears and pursuing a fresh path. Other points to investigate include consolidating college debts, preparing for homeownership, evaluating your health status, and dealing with stress before it affects your mind and body. Review the following questions to gain more clarity on your next decade of life.

Is My Career on Course?

Don’t be worried if you wonder about the state of your career. Most hard-working adults begin to question the wisdom of their job choices when they close in on their thirtieth birthday. It’s a worthwhile question to ask because it demonstrates an inner concern for long-term personal satisfaction and happiness. If the feeling lingers, consider meeting with a professional vocational counselor to get some objective guidance. If you do desire to change gears, now is the time to prepare and train for a new path. There’s no shame in switching careers in mid-life or anytime. Millions of individuals do so every year.

Should I Consolidate Student Loans?

If you are making payments on more than one college loan, a consolidation can help save time and make monthly bill paying simpler. Not only does a standard consolidation have the power to remove the clutter from the budget, but it can help borrowers keep any federal financial benefits they currently receive. The point of consolidating is not to get lower payments but to bring a semblance of order to personal finances. Keep in mind that after consolidating, you might end up paying more for the debt throughout the course of the loan.

Additionally, borrowers can’t select their interest rate, unlike in a refinancing. When someone refinances education debt, they take out a brand-new loan obligation that comes with a fresh set of terms and rates based mostly on the person’s credit rating. The wisest way to gather information on the subject is to review an informative guide about college debt consolidation that walks through all the advantages and disadvantages of the process.

Is Homeownership a Good Idea?

Everyone entertains the homeownership question at some point in their life. In nearly every case, owning a house is a wise financial and personal goal. Compared to renting, owning property allows people to build equity, establish better credit scores, and enjoy generally more comfortable surroundings. For centuries, owning property has been viewed as the single most essential part of social and financial stability.

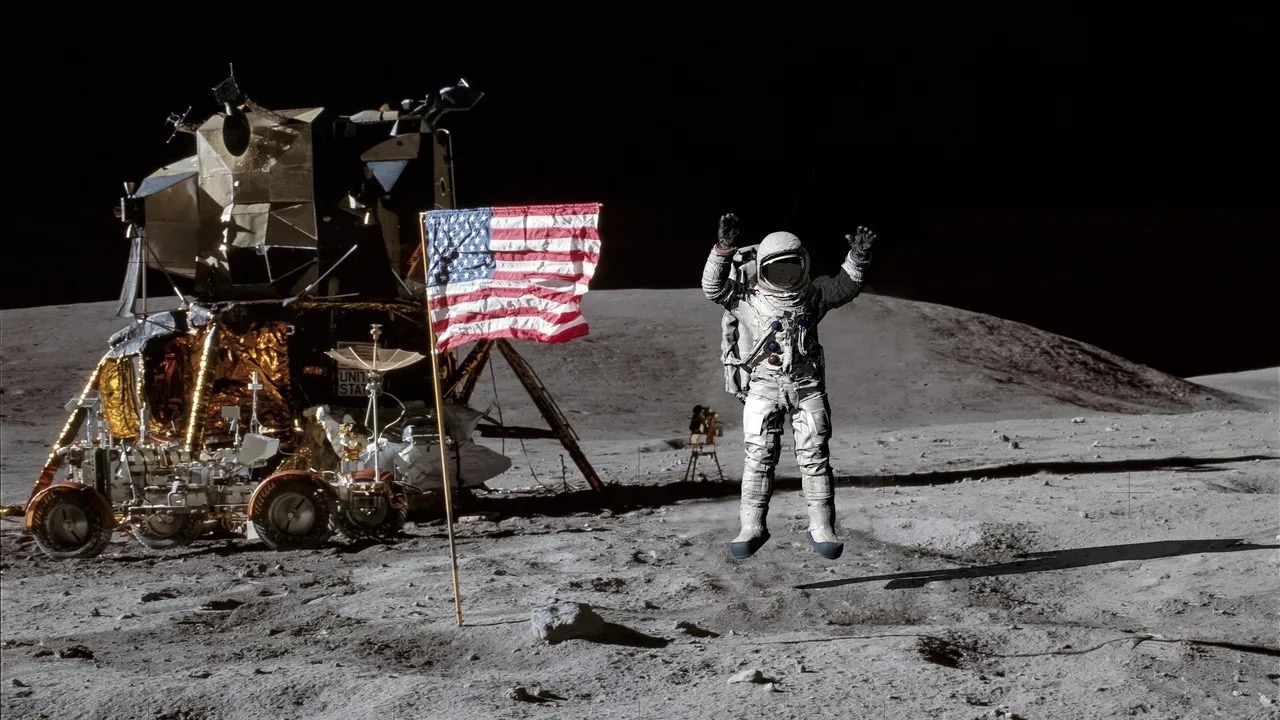

Is My Health Situation Good or Bad?

If you were able to dodge doctors and medical check-ups before, now is the time to change your ways. The human body is not built to last forever, and many of the most common problems begin to appear after age 30. The only way to know for sure whether your health is good or bad is to visit a doctor for a full physical examination. Fortunately, nearly every health insurance company reimburses some or all the cost of annual check-ups.

How Can I Minimize Everyday Stress?

The modern world is a stressful place. One reason anti-stress books are such hot sellers is the high demand for effective solutions. No one approach works for everyone, but large numbers of individuals find success with things like massage, regular exercise, meditation, short naps, morning walks, hot baths, and prayer. Speak with a trusted healthcare provider to find out about specific techniques that suit your lifestyle.