There are two types of traders, ones with the ability to take high-risk trades and traders who hate taking risks. Risk-averse is a term referring to the latter and risk-averse traders need to build a strong portfolio with assets that have low risk and lower rewards respectively. In the world of financial markets high risks usually correspond to high rewards and vice versa, finding the balance between the two is key for risk-averse traders. In this guide below, we are going to explain how to build a currency portfolio that contains the lowest risks and how to determine which currencies are strongest in a live market scenario.

Currency strength meter – a main tool in risk-averse trader’s arsenal

In the financial world information is everything and it controls every aspect of trading. If you had a magic tool to show you the strongest currency from all available pairs that would allow you to be far ahead of other traders on the market. The Currency Strength Meter or CSM indicator compares currencies of different FX pairs and displays the currencies by their strength. With this little technical indicator, it becomes possible to anticipate which currency will outperform others. If there is a trend going and the CMS shows one of the currencies is stronger than the other then taking positions in a dominant currency direction would be less risky. In Forex markets, controlling risks is key to long-term survival, and with advanced tools analyzing markets on the trader’s behalf, it is possible to obtain an edge and become profitable. While many indicators are subject to lagging, meaning they only show signals when the move has already happened. The CMS and similar indicators can eliminate this disadvantage as they can indicate which is the strongest asset.

Risk diversification in Forex markets

Building a diversified portfolio is critical for successful trading performance as it enables traders and investors to buy assets in different sectors or invest in non-correlated currencies. Risk management is a key factor in successful trading and building a well-diversified portfolio can limit the risks while increasing the chances of profits. Diversification is just one useful aspect of risk management and it will require a well-thought-out risk management plan to minimize losses and maximize profits. The only way to diversify your current portfolio is to invest only in non-correlated pairs. With this approach, it will be possible to not get into risky positions where two or more of your assets are moving in the same direction.

The ultimate Forex portfolio of risk-averse investors and traders

The most intuitive approach when building a portfolio of FX currencies is to buy strong currencies and sell the weaker ones. Let’s discuss an example to understand it better. In Forex markets currencies are pegged against each other. In the case of the EURUSD pair the EUR is a base currency and the USD is a quoted currency. EURUSD reflects how much US dollar you have to pay to buy 1 EUR. When the dollar is stronger it means you need fewer and fewer dollars for buying the same amount of EUR. On the EURUSD chart, this will be shown by a downtrend. So if a CSM indicator shows that USD is stronger than EUR and if this is supported by fundamentals what it means is that EURUSD could be heading lower and forming a downtrend. This way CSM indicator could provide valuable insight into the Forex market and help build a portfolio where the trader is long on strong currencies and shorts only on weak currencies. Some pairs like EURUSD and GBPUSD are heavily correlated and it is not recommended to open trading positions on both pairs at the same time, it is much better to invest in non-correlated pairs and buy strong and short weak currencies. In EURUSD’s case, you would short the pair if you wanted to buy USD.

Step-by-step strategy for building the risk-averse FX basket

Step 1: Scan markets with the CSM indicator to find out which currencies are stronger and which ones are weak

Step 2: Analyze trends and see which currency pair trends are agreeing with the CSM indicator

Step 3: Check the economic calendar to see what fundamentals have to say about the currencies you are trading

Step 4: Select two or more currency pairs that are not correlated and are in line with fundamentals and CSM indicator

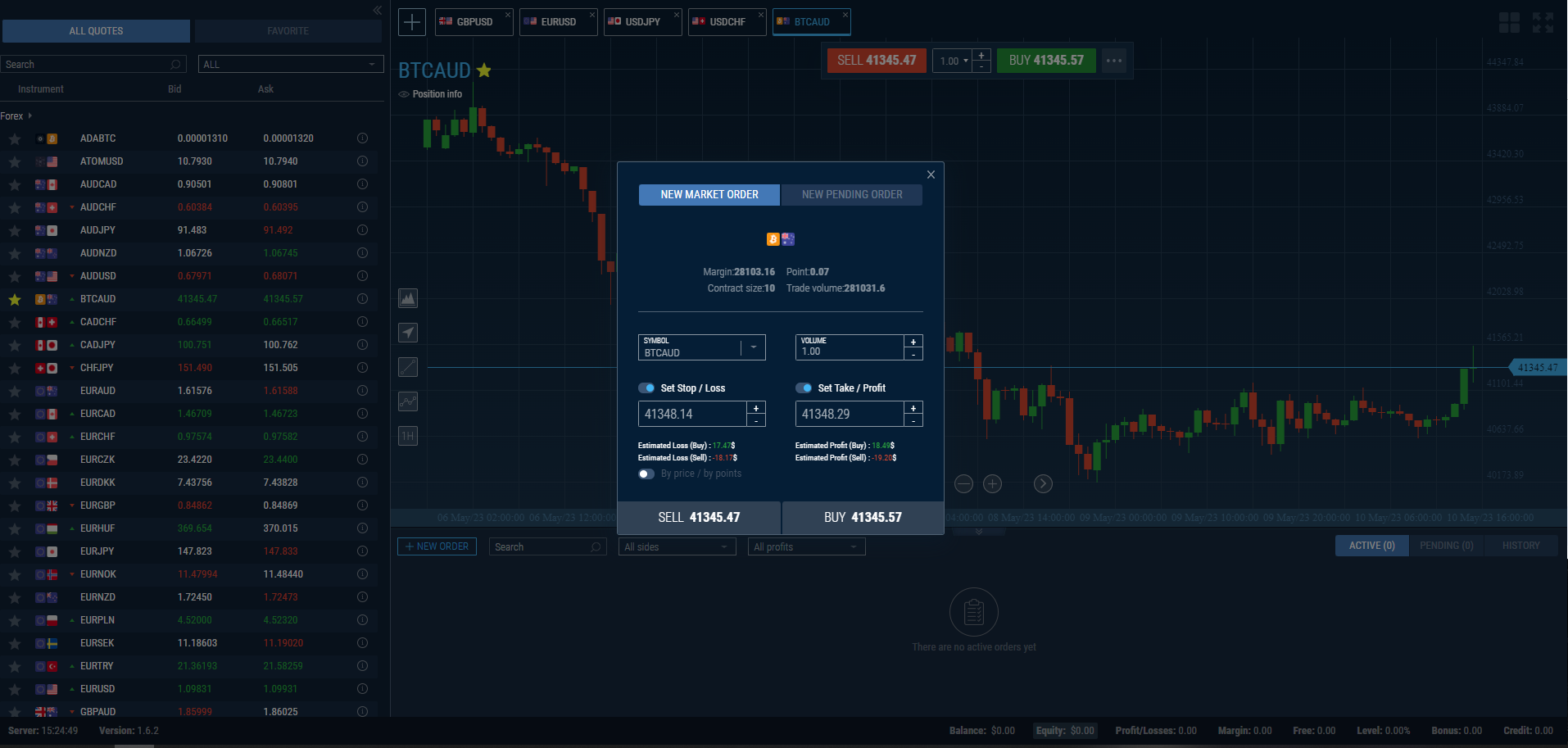

Step 5: define your risk and reward before entering the market not to risk more than your portfolio can handle

These five steps can be used to build a well-diversified portfolio supported by both fundamental and technical indicators increasing your chances of success several times. If you want to build an even better risk-averse portfolio then it is a good idea to invest in different classes of assets meaning in Forex, stocks, and other assets simultaneously greatly reducing your risks. But trading several assets at the same time will require significantly more experience and discipline and it will be very difficult to achieve. For beginners, it is still best to use the five steps described above to build a well-diversified Forex portfolio.