In an era of economic uncertainties, rising inflation, and fluctuating markets, the time has come to think about your golden years, sooner than you may have imagined. Retirement financial planning is not a niche anymore. It is the new “in” thing, captivating individuals from all walks of life, and for good reasons.

Redefine Financial Freedom

A financial revolution is brewing as more and more people are putting their future first, redefining the very meaning of financial freedom. Retirement financial planning is the cornerstone of this revolution, enabling individuals to lay down a robust financial foundation for their post-retirement life.

The Role of Fintech and AI

The rise of fintech companies and the growing influence of artificial intelligence have democratized retirement financial planning, making it accessible to the masses. In the past, only the affluent had access to professional retirement advice. But now, digital platforms are offering custom-tailored financial advice at a fraction of the cost, making it feasible for everyone.

The “New Normal”

Retirement financial planning is becoming the “new normal,” reflecting a change in mindset. People are acknowledging that life is uncertain, but financial stability in retirement doesn’t have to be. They are stepping up their game, contributing more to their retirement funds, diversifying their investments, and seeking professional financial advice.

The Impact of Early Planning

Those who start planning their retirement finances early are more likely to lead a comfortable life post-retirement. They are less likely to outlive their savings, more capable of dealing with financial emergencies, and better at managing their daily expenses. They have the financial freedom to pursue their passions, travel the world, or simply enjoy a leisurely life.

Retirement Planning – A National Priority

The U.S. government is also stepping up, recognizing retirement planning as a national priority. Policies are being revised, tax benefits are being offered, and awareness campaigns are being run. The message is clear – start planning for your retirement now.

In conclusion, the financial world is witnessing a revolution where retirement financial planning is not an option but a necessity. The earlier you start, the better off you’ll be in your golden years. So, it’s time to get on board with this new trend and secure a financially independent future for yourself.

The Ever-Changing Landscape of Retirement Planning

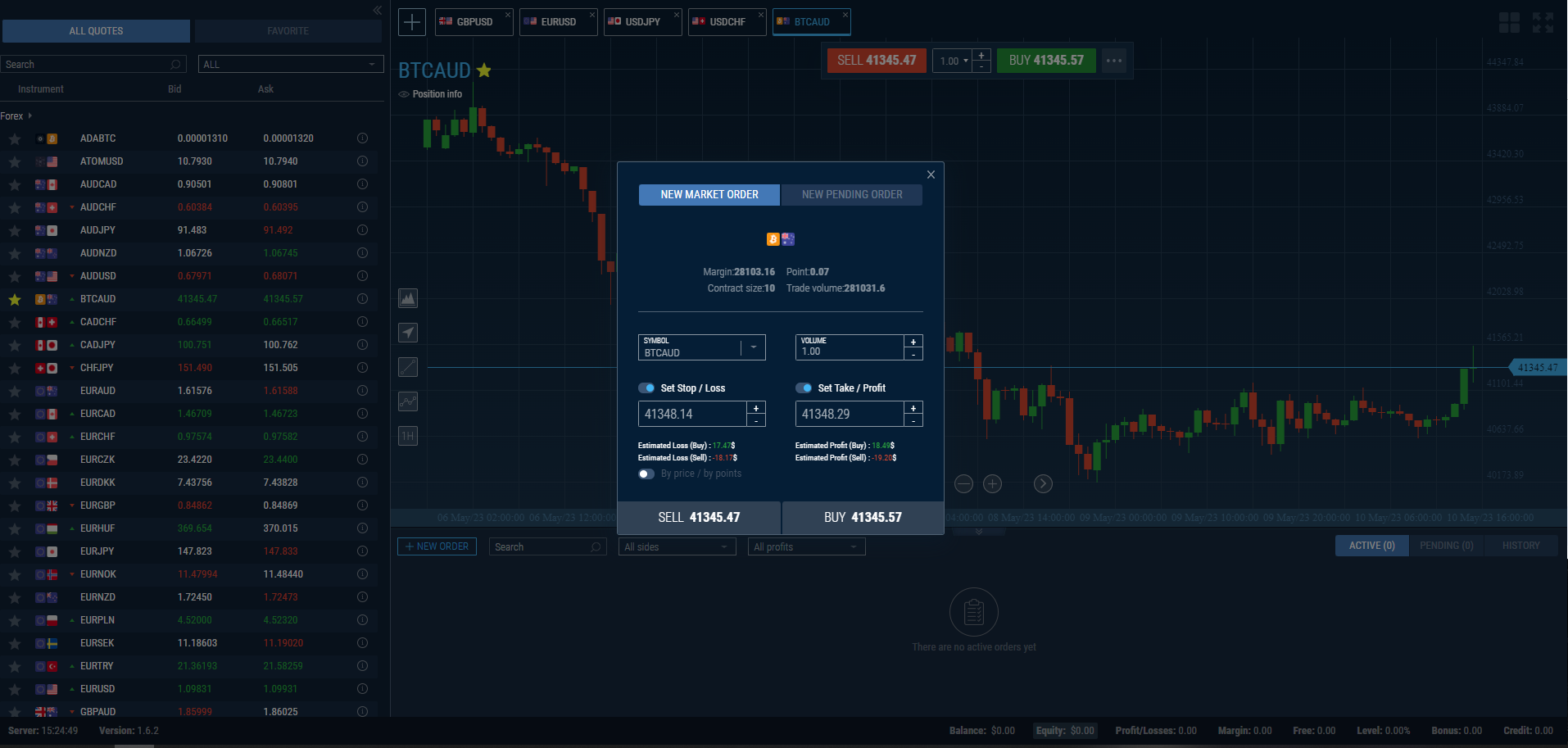

In the era of evolving economies, the landscape of retirement planning has changed dramatically. Traditional retirement plans such as 401(k)s and IRAs continue to be popular, but alternative investment options like cryptocurrencies, peer-to-peer lending, and real estate crowdfunding have also entered the scene, offering diversification and potentially higher returns.

The Rise of Robo-Advisors

The advent of robo-advisors has added a new dimension to retirement planning. They offer personalized investment advice based on your risk tolerance, financial goals, and time horizon. Robo-advisors not only offer a cost-effective alternative to traditional financial advisors but also make investing for retirement more accessible and straightforward.

Financial Literacy – A Key to Successful Retirement Planning

The increased focus on retirement planning has underscored the importance of financial literacy. A basic understanding of financial concepts like compound interest, diversification, inflation, and tax efficiency can significantly influence retirement planning decisions. Several non-profit organizations, educational institutions, and fintech companies are offering resources and tools to promote financial literacy, fostering a culture of informed decision-making.

The Psychological Shift

Retirement planning is not just about numbers and investment options. It’s also about a psychological shift in how we approach our finances. It’s about understanding the value of money, the importance of savings, and the role of discipline in achieving financial goals. The new-age retirement planning encourages us to take charge of our financial future rather than leaving it to chance.

Climate Change and Sustainable Investing

In an increasingly environmentally conscious society, sustainable investing has become a part of retirement planning. ESG (Environmental, Social, and Governance) investing allows individuals to align their investment choices with their values without compromising on potential returns. As the demand for sustainable investing grows, more and more investment products are being designed to cater to this trend.

Planning for Health Care Costs

One of the most significant challenges in retirement planning is accounting for healthcare costs, which are expected to rise substantially in the coming years. Long-term care insurance, health savings accounts (HSAs), and Medicare supplement plans are some of the options being considered to cover these expenses.

In the end, the essence of retirement planning lies in its ability to provide financial security and peace of mind. As the trend continues to evolve, the focus will remain on creating a retirement strategy that suits individual needs, goals, and circumstances. The key is to start early, stay informed, and adapt to changing economic conditions. And remember, it’s never too late to start planning for your golden years.